Pro rata pay is simply a way of calculating pay based on the proportion of hours someone works compared to a full-time employee. In short, it’s all about making sure part-time staff are paid fairly for the hours they put in, receiving a proportional slice of the salary and benefits.

What Is Pro Rata Pay and Why Does It Matter?

At its heart, pro rata pay is about fairness. It’s a principle you build directly into your payroll to ensure part-time employees are compensated in direct proportion to their full-time colleagues. This doesn't just cover their salary; it extends to benefits and holiday entitlement too.

Think of it this way: if a full-time role is advertised at £40,000 a year for a 40-hour week, an employee working 20 hours per week in that same role should get exactly half: £20,000. It's that straightforward.

This isn’t just good practice—it's a legal requirement. In the UK, the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000 locks this principle into law, making accurate calculations a matter of compliance, not choice. You can get to grips with the foundational concepts in our guide on how to work out FTE. For any modern HR leader, mastering pro rata pay is non-negotiable for a few key reasons:

- Attracting Talent: It allows you to offer flexible working arrangements, which opens up your talent pool to skilled professionals who need or want part-time roles.

- Boosting Morale: When people feel they're being paid fairly, their engagement and loyalty skyrocket. It’s a simple equation.

- Ensuring Compliance: Getting pro rata rules right helps you sidestep costly legal challenges and employment tribunals.

Pro Rata Pay at a Glance

To put it all into perspective, here’s a quick summary of what pro rata pay involves and why it's so important for your business.

| Component | Description | Primary Impact |

|---|---|---|

| Core Principle | Pay and benefits are calculated proportionally based on hours worked versus a full-time equivalent. | Ensures fairness and equity for part-time staff. |

| Legal Basis (UK) | Part-time Workers Regulations 2000 mandates no less favourable treatment for part-time employees. | Makes accurate calculations a legal requirement, not an option. |

| Key Applications | Applies to annual salary, holiday entitlement, sick pay, bonuses, and other contractual benefits. | Promotes a consistent and equitable reward structure across the entire workforce. |

| Business Benefits | Attracts a diverse talent pool, boosts employee morale, and ensures legal compliance. | Strengthens the employer brand and reduces financial risk from tribunal claims. |

Ultimately, understanding and applying these principles correctly is fundamental for any UK business with a flexible or part-time workforce.

The financial and legal stakes are high. For instance, if a full-time employee earns the median UK hourly wage of £19.74, a part-timer doing half the hours in the same role must receive that exact same rate. Getting this wrong can lead to tribunal claims, which, according to various reports, have resulted in average awards of £8,000-£12,000 for part-time workers since 2010. You can find more insights into UK wage trends on platforms like Statista.

Pro rata is much more than a calculation; it’s a strategic tool for building an equitable, diverse, and legally sound workforce. Getting it right sends a clear message about your company's commitment to fairness, which is a massive boost to your employer brand.

Getting to Grips with Pro Rata Salary Calculations

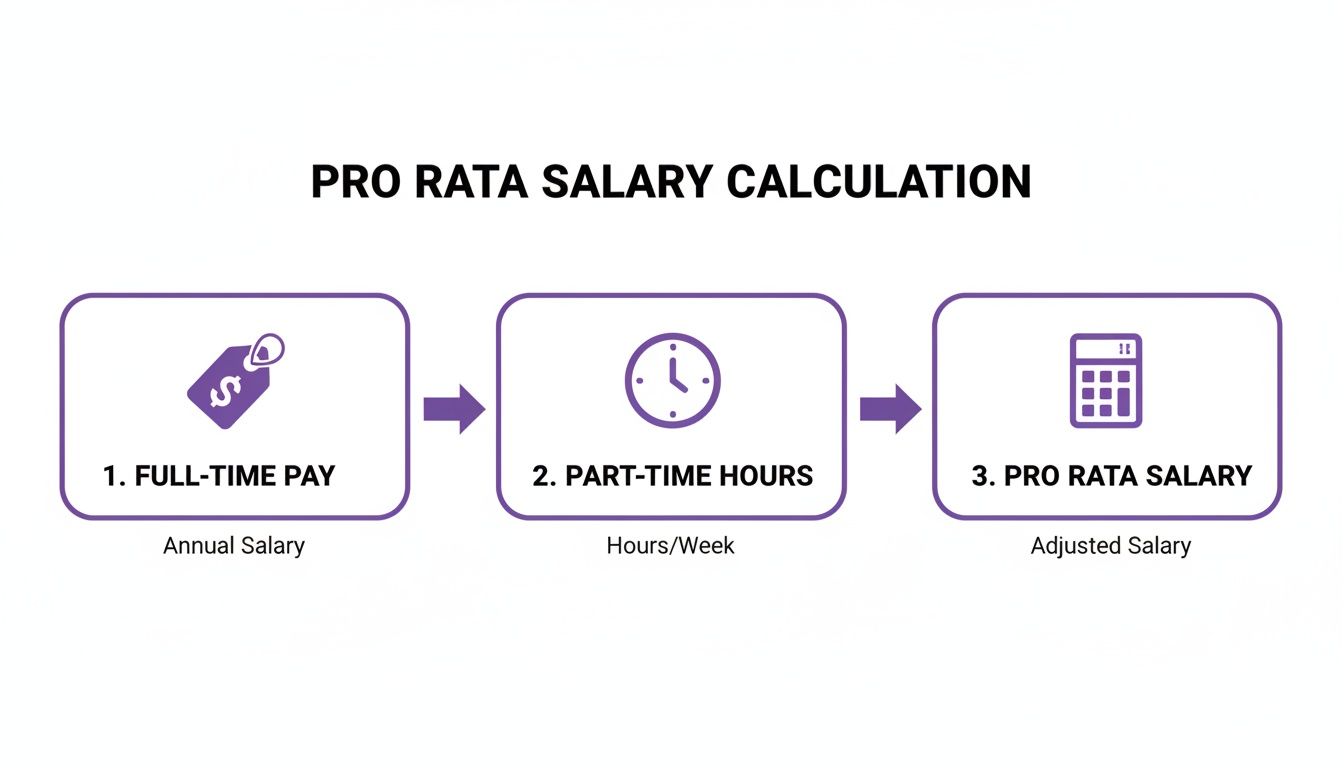

Alright, let's move from the 'what' to the 'how'. Calculating a pro rata salary is actually pretty straightforward once you get the hang of it. The core idea is always the same, whether you're dealing with annual salaries or hourly wages: figure out what the full-time role is worth, then scale it down to match the part-time hours.

Getting this right is crucial. It’s not just about paying people correctly; it’s about ensuring fairness across your entire team.

The Go-To Formula for Salaried Staff

For salaried employees, which is the most common scenario, you only need three bits of information:

- The full-time equivalent salary.

- The standard full-time hours or days per week.

- The part-time hours or days the employee will work.

Here’s the formula you’ll use:

(Full-Time Salary / Full-Time Hours) x Part-Time Hours = Pro Rata Salary

Let’s put it into practice. Imagine you're offering a role with a full-time salary of £50,000 per year, based on a typical 5-day week. Your new hire is going to work 3 days a week.

- First, find the value of a single day: £50,000 / 5 days = £10,000.

- Next, multiply that daily value by the days they’ll actually work: £10,000 x 3 days = £30,000.

Simple as that. The employee’s pro rata salary is £30,000 per year. This method is transparent and easy to explain, which builds trust from day one.

What About Hourly Workers or Mid-Month Starters?

The same logic applies perfectly well to hourly workers. With the UK's median full-time hourly pay on the rise, it's more important than ever to get these numbers spot on to stay competitive and compliant. You can see the latest earnings and employment trends from the ONS to get a feel for the current landscape.

Things get a little trickier when someone starts or leaves part-way through a month. This is where manual calculations can start to go wrong.

To calculate pay for an employee starting mid-month, you need to work out their pay for the exact number of days they were on the payroll. This usually means dividing their annual pro rata salary by the total number of working days in the year and then multiplying it by the days they worked that month.

This is exactly where manual processes show their weakness. A single slip-up—a misplaced decimal or a wrong day count—can easily lead to paying someone too much or, even worse, too little.

When an employee is leaving, you often have to make similar pro rata adjustments for things like final pay and unused holiday entitlement. Tools like an online severance calculator can be useful for double-checking these one-off, complex figures during the offboarding process.

But for your day-to-day payroll, relying on manual calculations and external tools is just not sustainable. It’s slow and leaves you wide open to human error, which is why having an automated, reliable HR system is a game-changer.

Mastering Pro Rata Holiday Entitlement

Holiday pay is one of those areas that can quickly turn into a real headache for businesses. It's easily one of the most common and complex parts of pro rata pay, and getting it wrong can lead to some serious compliance risks. This isn't just about being fair; it's a legal requirement that protects both your part-time employees and your company.

In the UK, the law is clear: every full-time employee is entitled to a minimum of 5.6 weeks of paid holiday each year. That same right extends to your part-time staff, but it's scaled down proportionally. The core idea is simple—a part-timer gets the same entitlement as a full-timer, just adjusted for the hours they actually work.

Calculating Holiday Entitlement for Part-Time Staff

Let's walk through how this works in practice. A typical full-time employee on a 5-day week gets 28 days of statutory leave (that's 5.6 weeks x 5 days).

So, what about a part-time employee who works a 3-day week? To figure out their pro rata holiday, you just apply the same logic:

5.6 weeks x 3 days = 16.8 days of paid holiday per year.

It’s that straightforward. The key is keeping accurate records because even a small slip-up can cause disputes down the line. This calculation is your bedrock for managing leave fairly for everyone on the team.

This flowchart breaks down the logic, showing how you start with a full-time baseline and adjust it to find the correct pro rata figure.

While the image talks about salary, the principle is identical for calculating holiday entitlement. You establish the full-time equivalent and then scale it down based on the actual hours or days worked.

To make this even clearer, let's look at a few common part-time work patterns.

Example Pro Rata Holiday Calculations

| Full-Time Equivalent (FTE) Days/Week | Part-Time Days/Week | Pro Rata Holiday Entitlement (Days) |

|---|---|---|

| 5 | 4 | 22.4 (5.6 x 4) |

| 5 | 3 | 16.8 (5.6 x 3) |

| 5 | 2.5 | 14 (5.6 x 2.5) |

| 5 | 2 | 11.2 (5.6 x 2) |

| 5 | 1 | 5.6 (5.6 x 1) |

As you can see, the calculation scales directly with the number of days worked per week, ensuring everyone receives their fair, proportional entitlement based on the statutory 5.6 weeks.

Handling Irregular Hours and Zero-Hours Contracts

Things get a bit trickier when you have employees working irregular hours or on zero-hours contracts. You can't just multiply by the number of days they work because that number changes all the time.

For these situations, holiday entitlement is calculated as 12.07% of the hours they’ve worked.

Where does that number come from? It's derived from the statutory 5.6 weeks of holiday, which leaves 46.4 working weeks in a year (52 total weeks – 5.6 holiday weeks). The percentage is simply 5.6 divided by 46.4.

For example, if someone on a zero-hours contract works 100 hours in a given period, their holiday entitlement for that time is 12.07 hours (100 hours x 12.07%).

This method makes it absolutely essential to keep meticulous records of every hour worked. It’s the only way to ensure these employees get the holiday pay they're legally owed. If you want to dig into the finer details, our guide on how to work out your holiday entitlement covers this in depth.

UK regulations are designed to ensure this fairness is baked into every pro rata calculation. By applying these rules consistently, you not only strengthen employee rights from day one but also significantly reduce your risk of facing a tribunal claim. For the most up-to-date information, it's always worth checking the official guidance on UK wage rates.

Applying Pro Rata Rules Beyond Salary

True fairness in compensation isn’t just about getting the annual salary or holiday allowance right. The principle of pro rata pay has to trickle down through the entire rewards package to keep things equitable and legally sound. It's about looking at every single benefit and entitlement through a lens of proportionality.

When an employee’s package is more than just a basic salary, these calculations get a bit more complex, but they’re just as important. This is especially true for statutory entitlements, where eligibility often comes down to an employee's average earnings over a specific period.

Statutory Entitlements and Average Earnings

In the UK, several key statutory payments hinge on an employee's average weekly earnings. For part-time staff, this calculation automatically builds in their pro rata status.

- Statutory Sick Pay (SSP): To get SSP, an employee's average weekly earnings must hit a minimum threshold. For part-timers, this average is calculated over a set reference period, which ensures their eligibility is assessed fairly based on what they actually earn.

- Parental Leave Pay: It's the same story for entitlements like Statutory Maternity, Paternity, Adoption, and Shared Parental Pay—they're all tied to average earnings. The pro rata pay someone receives directly impacts whether they qualify and how much they get during their leave.

If you aren't tracking hours and pay accurately for part-time staff, you risk miscalculating these crucial benefits. That’s a one-way ticket to compliance headaches and, understandably, a lot of stress for the employee.

The legal principle holding all this together is simple: avoid 'less favourable treatment'. Part-time employees must have proportional access to the same benefits and opportunities as their full-time colleagues, unless there's a very good, objective business reason why they can't.

Company Benefits and Proportional Access

Looking past your legal duties, the pro rata rule also applies to the company benefits you offer to attract and keep great people. This is where thinking about total rewards as a single, unified package really matters.

Think about these common examples:

- Pension Contributions: If your company contributes a percentage of salary to a pension scheme, that percentage has to be applied to the employee's actual pro rata salary, not the full-time equivalent.

- Performance Bonuses: A bonus scheme needs to be applied proportionally. Let's say a full-time employee hits their targets and earns a £2,000 bonus. A part-time employee working 50% of the hours who achieves the exact same level of performance should receive a £1,000 bonus.

- Private Health Insurance: It’s obviously tricky to "pro-rate" an insurance policy. But you can't just exclude part-time staff. Usually, the solution is to offer them the full benefit, because leaving them out could easily be seen as discriminatory.

This growing complexity really shines a light on the need for a connected system. It's where solutions like Hubdrive’s HR Management, built on the Microsoft Dataverse, come in. They can handle these intricate rules automatically, making sure every employee gets their fair and correct entitlement without someone having to check every calculation by hand.

Why You Should Automate Pro Rata Calculations

Relying on spreadsheets to manage pro rata pay, holidays, and benefits is a bit like trying to navigate a motorway with a paper map. It might get you there eventually, but it's slow, full of potential wrong turns, and ultimately puts your business at risk. Manually tracking all those moving parts is a recipe for compliance headaches, wasted admin hours, and unhappy employees.

For any modern business, moving away from spreadsheets isn't just an upgrade; it's a necessity. The right tools can completely lift this administrative burden, freeing up your HR team to focus on people, not paperwork. An integrated system ensures every calculation is accurate and consistent, every single time.

The Power of a Single Source of Truth

Modern HR systems, like Hubdrive’s HR Management for Microsoft Dynamics 365, are built to handle the fiddly bits of pro rata pay automatically. Forget about manual data entry and wrestling with complex formulas; the platform does all the heavy lifting for you.

Here’s how it changes the game:

- Automatic Calculations: The system works out pro rata pay, holiday allowances, and benefit entitlements based on each employee's specific contract and working pattern.

- Seamless Data Flow: Because time and attendance data feeds directly into the payroll module, every calculation is based on real-time, accurate information.

- Guaranteed Accuracy: Taking human error out of repetitive calculations means the risk of costly mistakes is virtually gone.

What you end up with is a single source of truth for all your HR data. No more cross-referencing different spreadsheets or second-guessing which file is the most up-to-date. Every figure is connected, consistent, and correct. You can learn more about how a centralised platform works by checking out our guide on what is an HRMS system.

Strengthening Compliance and Auditability

Beyond saving time, automation gives you an invaluable layer of protection. If you ever face a dispute or an audit, you need to be able to show exactly how you reached a certain figure. An automated system provides a clear, auditable trail for every calculation.

An integrated HR platform doesn't just calculate pro rata pay; it documents the entire process. This provides a robust defence against potential tribunal claims and simplifies compliance reporting, giving you complete confidence in your data.

This means you can easily prove that your pro rata policies are applied fairly and consistently across the board, protecting you from legal challenges under the Part-time Workers Regulations. By automating these critical functions, you shift from a reactive, compliance-driven mindset to a proactive, strategic way of managing your workforce.

We are DynamicsHub.co.uk. Experience HR transformation built around your business. Hubdrive’s HR Management for Microsoft Dynamics 365 is the premier hire‑to‑retire solution—more powerful, more flexible, and more future‑ready than Microsoft Dynamics 365 HR.

To see how automation can protect your business and empower your team, phone 01522 508096 today or send us a message.

Your Path to Compliant and Efficient Payroll

Getting pro rata pay right isn't just a box-ticking exercise; it's a cornerstone of fair, legal, and smart HR management here in the UK. We've walked through how to calculate salaries, handle holiday entitlements, and apply the rules to benefits. The clear next step is moving away from risky manual spreadsheets and towards an automated system that protects your business and looks after your people properly.

That's the transition we help businesses like yours make at DynamicsHub.co.uk.

Embrace a Smarter Way to Manage HR

We can help you build an HR system that works exactly the way your business does. Hubdrive’s HR Management for Microsoft Dynamics 365 offers a complete hire‑to‑retire solution that’s more powerful and flexible than the standard Microsoft Dynamics 365 HR. This is about more than just installing software; it's about creating a solid foundation for growth, compliance, and genuine employee satisfaction.

Automating pro rata calculations gives you a single source of truth. It stamps out errors and creates a clear, auditable trail. This not only shields your organisation from compliance headaches but also sends a powerful message to your entire team that you’re committed to fairness and transparency.

To really cement your team's expertise in the nuances of payroll, including tricky pro rata calculations, enrolling key staff in a specialized payroll training course is a brilliant investment.

Ultimately, the aim is a payroll function that just works—smoothly, accurately, and without stress. To see how we can help you implement a system that does exactly that, give us a call on 01522 508096 or send us a message to start the conversation.

Got Questions? Your Pro Rata Pay Scenarios, Answered

Even when you’ve got the basics down, real-life situations can throw a spanner in the works. Let’s tackle some of the most common head-scratchers HR professionals face when it comes to pro rata pay.

How Do You Handle Bank Holidays for Part-Time Employees?

This one trips up a lot of people, but the principle is simple: part-time staff get a pro-rata equivalent of bank holidays. It’s all about fairness and proportion.

Imagine your full-time staff, who work five days a week, get eight bank holidays. A part-timer doing three days a week is entitled to their fair share, which works out to 4.8 bank holidays (3/5 of 8).

If a bank holiday happens to fall on one of their usual working days, they just take that day off, and it comes out of their 4.8-day allowance. But what if it doesn't? That's when you add the time to their overall holiday pot, letting them take it another day.

What Happens If an Employee Changes Hours Mid-Year?

When an employee’s hours change partway through the year, you need to draw a line in the sand. From that exact date, their pro rata salary and holiday entitlement must be recalculated. Think of it as splitting their year into two separate periods.

You'll have one calculation for the time they spent on their old contract, and a new one for the rest of the year on their new hours. It’s perfectly doable with a calculator and a bit of patience, but this is exactly where mistakes love to creep in. This is why having a solid HR system is a lifesaver; a solution like Hubdrive's HR software can handle these recalculations automatically, keeping everything accurate and seamless.

Are Bonuses and Commissions Paid on a Pro Rata Basis?

In short, yes—almost always. The core principle of not treating part-time workers less favourably applies squarely to performance-related pay. Unless you have a very clear and objective business reason not to, bonuses and commissions must be paid pro rata.

For example, a full-time employee hits their targets and earns a £1,000 bonus. A part-time colleague working half the hours, who meets the same standard of performance, should receive a £500 bonus. This keeps the reward directly in line with their contribution and their contracted hours.

At DynamicsHub, we take the complexity out of HR, turning manual headaches into simple, automated processes. We help you build an HR foundation that’s designed for your business. Hubdrive’s HR Management for Microsoft Dynamics 365 is the premier hire‑to‑retire solution—more powerful, more flexible, and more future‑ready than Microsoft Dynamics 365 HR.

To see how we can help, give us a call on 01522 508096 today or send us a message.