Calculating a pro rata salary is actually quite simple once you get the hang of it. It’s all about working out fair pay for anyone not working a standard, full-time year.

The basic idea is to take the full-time equivalent (FTE) salary, break it down into an hourly or daily rate, and then multiply that by the actual time the employee works. This is the bedrock of fair pay for part-time staff and anyone who joins or leaves part-way through a pay period.

Understanding Pro Rata Salary Essentials

'Pro rata' is just a fancy Latin term for 'in proportion'. When we talk about it in UK payroll, it's the principle we use to make sure part-time employees are paid fairly compared to their full-time colleagues.

Getting this right isn't just good practice; it's a legal requirement under the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000. So, it’s something you really need to get right.

You'll find yourself needing to do this calculation in a few common situations:

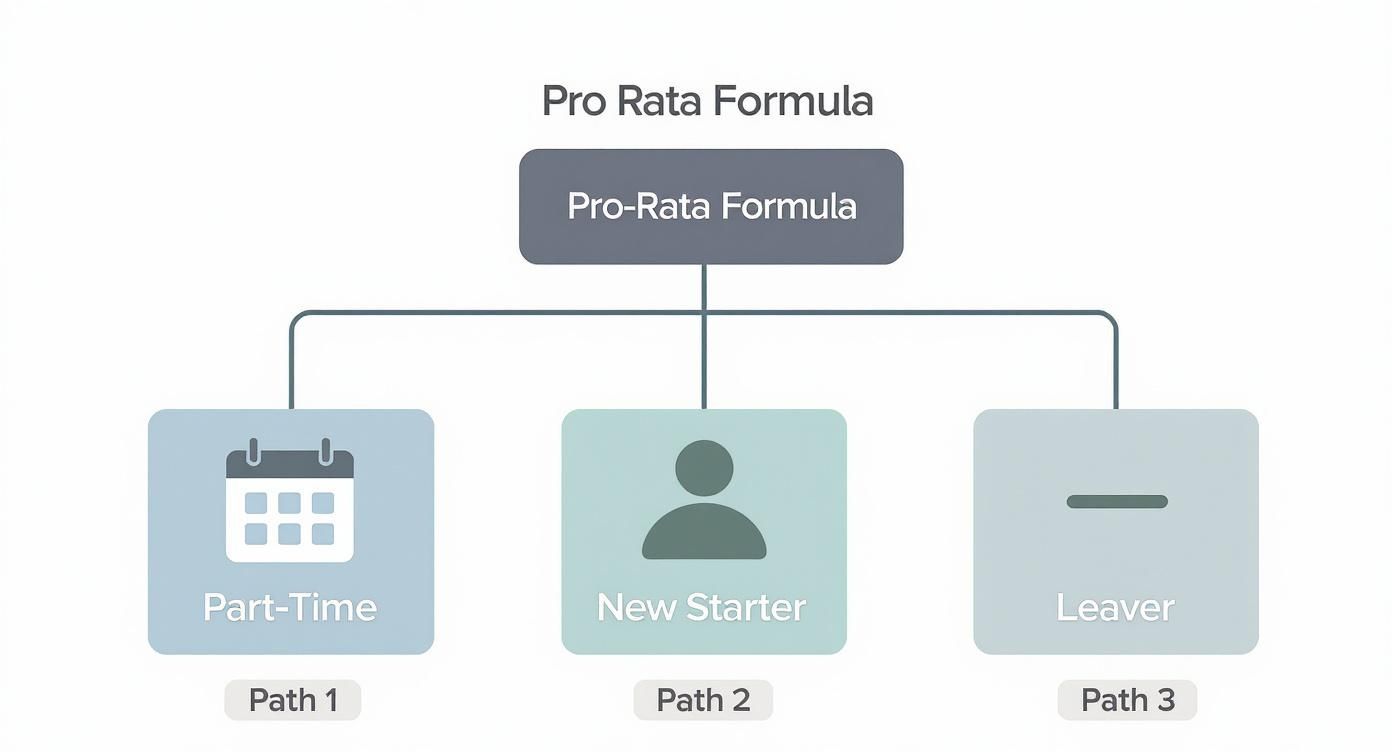

- Part-Time Employees: This is the big one. It ensures someone working three days a week gets a fair slice of the five-day equivalent salary.

- New Starters: When an employee joins your company midway through a month, their first payslip needs to be calculated on a pro rata basis.

- Leavers: It’s the same story for an employee's final salary. It has to be adjusted based on the exact portion of the pay period they worked.

- Variable Hours: For team members whose hours fluctuate, pro rata calculations make sure their pay accurately reflects their work.

Why Accurate Calculations Matter

I can't stress this enough: precision is absolutely key here. Even a small miscalculation can lead to underpayment, which erodes trust and can quickly spiral into a dispute. On the flip side, overpaying an employee throws off your financial forecasting.

And it doesn't stop at their basic pay. Getting the pro rata salary wrong has a knock-on effect on other crucial entitlements, like holiday pay and pension contributions, as these also need to be calculated proportionally.

The first thing you need to do is define what 'full-time' actually means in your business. While a standard UK full-time week is often 35 to 40 hours, it can vary. If you're unsure, our guide on how many hours is full time can help you establish that baseline.

Once you have that number nailed down, you can confidently apply the formulas for any part-time or mid-period pay scenario. This foundational step ensures fairness, compliance, and solid financial management across your entire organisation.

The Nuts and Bolts: Core Formulas for Pro Rata Pay

Calculating pro rata salary isn't a simple, one-size-fits-all equation. The right formula really depends on the situation. Are you figuring out the annual salary for a part-time team member, or are you working out the first month's pay for a new hire?

Getting your head around a few key formulas will give you the confidence to handle these common payroll scenarios accurately. It’s crucial to get the method right from the start, as a small difference—like using working days instead of calendar days—can change the final pay packet. Consistency here is everything for keeping things fair and transparent.

Calculating for Part-Time Employees

This is probably the pro rata calculation you'll come across most often. When someone works fewer hours or days than your full-time standard, you need to figure out their proportional annual salary. The most straightforward and reliable way to do this is to get it down to an hourly rate.

Here's how I've always approached it:

- First, find the Full-Time Equivalent (FTE) annual hours. Just multiply your standard full-time weekly hours by 52. For a typical 37.5-hour week, that’s 1,950 hours a year.

- Next, calculate the hourly rate. Divide the full-time annual salary by those total annual hours.

- Finally, get the pro rata salary by multiplying that hourly rate by the part-time employee's total annual hours.

Let's say the full-time role pays £40,000 for a 37.5-hour week. The hourly rate works out to be £20.51 (£40,000 / 1,950). If you have an employee working 22.5 hours per week (that's 1,170 hours annually), their pro rata salary would come to £23,996.70 (£20.51 x 1,170).

Working Out Pay for Starters and Leavers

Things get a little different when an employee joins or leaves partway through the month. You’ve got to calculate their pay for just the portion of the month they actually worked. In the UK, there are two common ways to tackle this. The most important thing is for your company to pick one method and stick with it for everyone.

-

The Working Days Method: Many consider this the fairest approach because it pays the employee based on the number of days they were actually scheduled to work. The formula looks like this:

(Normal Monthly Salary / Total Working Days in the Month) x Number of Days Worked -

The Calendar Days Method: This one is a bit simpler as it just uses the total number of days in the month. It can, however, lead to slightly different outcomes, especially in a short month like February. The formula is:

(Annual Salary / 365) x Calendar Days Worked in the Pay Period

Let’s see it in action: An employee on a £36,000 annual salary (£3,000 per month) starts on the 16th of June. June has 30 calendar days and 22 working days that month. They worked 11 of those days.

- Using Working Days: (£3,000 / 22) x 11 = £1,500

- Using Calendar Days: (£36,000 / 365) x 15 = £1,479.45

That small difference is precisely why you need to clearly state your chosen method in employment contracts.

Ultimately, there isn't one universally "better" formula. What truly matters is that your organisation chooses a method, documents it clearly in the company handbook or contracts, and applies it consistently for every single employee. This simple step prevents payroll headaches and ensures everyone is treated the same.

To make things easier, here’s a quick reference table with the key formulas we've just covered.

Pro Rata Calculation Formulas at a Glance

| Scenario | Calculation Method | Example Formula |

|---|---|---|

| Part-Time Employee | Hourly Rate Conversion | (Annual FTE Salary / Total Annual FTE Hours) x Part-Time Annual Hours |

| Mid-Month Starter/Leaver | Working Days Method | (Monthly Salary / Working Days in Month) x Days Worked |

| Mid-Month Starter/Leaver | Calendar Days Method | (Annual Salary / 365) x Calendar Days Worked in Pay Period |

This table should serve as a handy cheat sheet when you're in the middle of a payroll run and need to double-check your approach.

A Practical Walkthrough for Part-Time Employees

Let's put the theory into practice with a scenario that lands on HR and payroll desks all the time. Imagine Sarah, one of your full-time marketing managers, has asked to move to a part-time schedule. This is a perfect real-world example to walk through how to calculate her new pro rata salary and benefits fairly and accurately.

Here are the key details for Sarah's transition:

- Full-Time Salary: £40,000 per year

- Full-Time Hours: 37.5 hours per week (based on a standard 5-day week)

- New Part-Time Hours: 22.5 hours per week (working a 3-day week)

Calculating the New Pro Rata Salary

The first job is to figure out Sarah's new annual salary based on her reduced hours. The most dependable way to do this is to work out her hourly rate from her full-time equivalent (FTE) salary. If you need a refresher on FTE, we've got a detailed guide on how to calculate FTE.

First, let's find the total annual hours for a full-time role: 37.5 hours/week × 52 weeks = 1,950 hours.

With that, we can calculate her hourly rate: £40,000 / 1,950 hours = £20.51 per hour.

Now, let's do the same for her new part-time schedule: 22.5 hours/week × 52 weeks = 1,170 hours a year.

So, her new pro rata annual salary comes to £20.51 × 1,170 hours = £23,996.70. To get her new gross monthly pay, we just divide this by 12, which gives us £1,999.73 before tax and other deductions.

This flowchart shows the different calculation paths you might take, whether you're dealing with a part-timer, a new starter, or a leaver.

As you can see, even though the reasons for the calculation differ, the core principle of proportionality is the constant that ensures everyone is paid fairly.

Adjusting Holiday Entitlement Correctly

Of course, it's not just about the salary. Holiday entitlement needs to be recalculated on a pro rata basis, too. This isn't just good practice; it's a legal requirement under the Part-time Workers (Prevention of Less Favourable Treatment) Regulations 2000. This legislation was a game-changer, ensuring the UK's 8.4 million part-time workers get a fair deal.

Let's say your company’s full-time holiday entitlement is 28 days a year, including bank holidays.

The formula for Sarah's new holiday allowance is straightforward:

(New Days Worked Per Week / Full-Time Days Per Week) × Full-Time Holiday Entitlement

So, for Sarah, that’s: (3 days / 5 days) × 28 days = 16.8 days.

In my experience, it's always best to round this figure up to the nearest half or full day. For Sarah, we would round her new annual holiday entitlement up to 17 days. This simple step avoids any confusion and makes it clear you're treating your employees fairly.

By following these calculations, you can manage Sarah's transition to part-time work smoothly and correctly, staying fully compliant with UK employment law. A structured and transparent approach like this is key to preventing payroll headaches and maintaining trust with your team.

Paying New Starters and Leavers

One of the trickiest parts of any payroll run is handling the first and last payslips for staff. When someone starts or leaves part-way through a month, you need to calculate their pay fairly, and getting it wrong is a fast track to a frustrated employee.

In the UK, there are two main ways to tackle this: the 'working days' method and the 'calendar days' method. Neither one is legally "correct," but the key is to pick one and stick with it. The method you choose can genuinely affect how much someone takes home, especially in a short month or one packed with bank holidays.

The Working Days Method

Most payroll experts I know, myself included, lean towards the working days method. It feels like the fairest way to do things because it ties pay directly to the number of days someone was actually contracted to work in that pay period.

The formula is pretty simple:

(Normal Monthly Salary / Total Working Days in the Month) x Days Actually Worked

Let's look at a real-world example. Say your new hire, David, has an annual salary of £36,000 (£3,000 per month). He starts on Monday, 15th April. April has 22 working days in total. From his start date to the end of the month, David will work 12 of them.

Here's the calculation:

(£3,000 / 22) x 12 = £1,636.36

So, David's first payslip would be for £1,636.36.

The Calendar Days Method

The other option, the calendar days method, is often seen as a bit more straightforward because it ignores weekends and bank holidays, simply using the total number of days in the month. It works by figuring out a daily rate from the employee's annual salary.

Here’s the formula for that:

(Annual Salary / 365) x Calendar Days Worked in the Pay Period

Let's run David's numbers again using this method. He starts on 15th April, a month with 30 calendar days. From the 15th to the 30th inclusive, he is employed for 16 calendar days.

The calculation looks like this:

(£36,000 / 365) x 16 = £1,578.08.

You can immediately see the difference. The working days method gave David a higher figure. While it might not seem like a huge amount, this is exactly why having a clear, documented policy is so important. It prevents any confusion or claims of unfairness down the line.

Consistency is Everything

The biggest takeaway here is to be consistent. Whichever method your business chooses, you must apply it to every single starter and leaver, without exception.

Make sure this policy is written down somewhere accessible, like in your employment contracts or the company handbook. This kind of transparency builds trust and shows your team that everyone is treated the same.

This principle is especially critical when calculating final pay for leavers, particularly in more complex situations like redundancy. If you need a deeper dive into that specific area, these guidelines on redundancy pay calculations are a great resource.

Ultimately, a consistent approach doesn't just ensure fairness; it makes your entire payroll process smoother and much easier to defend if a query ever pops up.

For help implementing a consistent and compliant payroll process, give us a call on 01522 508096 today or send us a message.

UK-Specific Rules: Thinking Beyond the Salary

Calculating a pro rata salary is the first step, but it doesn't exist in a vacuum. In the UK, you’ve got to factor in other statutory entitlements that need the same proportional treatment. Getting these details wrong isn't just a payroll headache; it can lead to compliance issues and leave your part-time staff feeling short-changed.

The two big ones you absolutely have to get right are holiday pay and pension contributions. These aren't just perks – they're legal requirements. Let's break down how to handle them.

Pro Rata Holiday Entitlement

Every full-time employee in the UK gets a minimum of 5.6 weeks of paid holiday each year. This is the law. It often includes bank holidays, and the crucial part is that this entitlement must be scaled down fairly for your part-time team members.

The most straightforward way to work this out is by looking at the number of days they work each week.

- The calculation looks like this: (Part-Time Days Worked ÷ Full-Time Days Worked) × Full-Time Holiday Allowance (in days)

Let's run through a quick, common scenario. Say your full-time staff work a 5-day week and get 28 days of annual leave (which is the statutory 5.6 weeks). Now, you hire someone to work 3 days a week.

Their holiday entitlement would be: (3 ÷ 5) × 28 days = 16.8 days

Now, here's a key bit of practical advice. You can't really give someone 0.8 of a day off. Standard practice in the UK is to round up to the nearest half or full day. So, in this case, you'd round that 16.8 up to 17 days. It’s a small gesture that keeps things clean, avoids any potential disputes, and shows you're a fair employer.

Pensions and Auto-Enrolment

Pension contributions under the UK’s auto-enrolment scheme are another area where proportionality is built-in. The calculations are based on an employee's actual earnings, not what they would be earning if they were full-time. This means part-time workers' contributions are automatically pro-rated.

As an employer, you have to enrol eligible staff into a workplace pension. For the 2024/25 tax year, the contributions are calculated on 'qualifying earnings' – that’s anything between £6,240 and £50,270 a year.

So, if you have a part-time employee with a pro rata salary of £20,000, their pension contributions will be calculated on that figure. Your payroll software should handle this automatically, but it's good to know why it works that way. It uses their actual gross pay for each pay period, ensuring the contribution is perfectly proportional.

A Quick Word on Statutory Sick Pay

Finally, let’s touch on Statutory Sick Pay (SSP). How does pro rata work affect this? To be eligible for SSP, an employee needs to earn, on average, at least the Lower Earnings Limit, which is £123 per week.

For most part-time staff, this isn't an issue. However, if you have an employee on very few hours, their pro rata earnings might dip below this threshold, making them ineligible for SSP. This is a critical compliance checkpoint to watch, especially for staff with minimal weekly hours. Make sure your payroll system can flag anyone who might fall into this category.

Ditching the Spreadsheets: Automating Pro Rata Calculations

As we’ve walked through the different scenarios, it’s clear that pro rata calculations aren't always straightforward. You're juggling multiple formulas, specific start and end dates, and a whole host of UK compliance rules. One wrong move in a spreadsheet can easily spiral into incorrect pay, messed-up holiday accruals, and, frankly, some very unhappy employees.

This is precisely where good HR technology steps in to save the day. An integrated Human Resources Management System can take this entire headache away by automating everything from salary and holiday pay to pension contributions. If you're new to this, our guide on what is an HRMS system explains how these platforms work.

Think about it: you set up your company's rules just once, and the system handles the rest. It ensures every calculation is spot-on and consistent, whether you're bringing on a new part-timer or managing a mid-month leaver. This isn't just about saving time; it's about eliminating the risk of human error and guaranteeing you're always compliant. Your HR team gets to focus on people, not pocket calculators.

At DynamicsHub, we live and breathe this stuff. We specialise in setting up systems like Dynamics 365 to handle all the fiddly details of UK payroll. A well-configured system doesn't just crunch the numbers—it gives you the confidence that your payroll is right, every single time.

Tired of wrestling with manual calculations? Give us a call on 01522 508096 today or send us a message to see how we can make your payroll process a whole lot simpler.

Common Questions About Pro Rata Salary

Even with the right formulas, things can get a bit sticky when you're actually running payroll. In my experience, a few common but tricky scenarios always seem to pop up. Let's tackle some of the most frequent questions I hear.

Getting these details right isn't just about compliance with UK employment law; it's about being fair and building trust with your team from day one.

What’s the Fairest Way to Pay Someone Who Starts Mid-Month?

This is a classic payroll puzzle. While both the 'working days' and 'calendar days' methods are used across the UK, I find the working days method is generally seen as the most equitable. It’s simple, transparent, and pays an employee for the exact number of days they were contracted to work in that month.

So, if someone works 10 out of 22 possible working days, they get precisely 10/22 of their normal monthly salary. The real key here isn't which method you choose, but that you choose one, state it clearly in your employment contracts, and then stick to it for everyone. Consistency is what prevents disputes down the line.

Are Bank Holidays Included in Pro Rata Holiday Calculations?

Yes, they absolutely are. This is a common point of confusion. In the UK, the statutory minimum holiday entitlement of 5.6 weeks includes bank holidays. For any part-time staff, you have to calculate their total entitlement on a pro rata basis.

Here's a quick example: A full-time employee on a five-day week gets 28 days' leave (which includes bank holidays). An employee working three days a week is therefore entitled to (3/5) * 28 = 16.8 days. Most employers round this up to 17 full days. If a bank holiday happens to fall on one of their normal working days, it simply gets deducted from this total allowance.

How Does Pro Rata Work for Zero-Hour Contracts?

The term 'pro rata salary' doesn't really fit here, since people on zero-hour contracts are paid an hourly rate for the time they actually work. Their holiday entitlement, however, is still worked out proportionally.

The standard way to handle this is to accrue holiday pay at a rate of 12.07% of the hours they’ve worked. This percentage isn't random; it comes from dividing the statutory 5.6 weeks of holiday by the remaining 46.4 working weeks in a year (5.6 / 46.4 ≈ 12.07%).

If you're dealing with really complex pro rata situations or need more in-depth HR advice, it can be a huge help to bring in some experts. Professional Human Resources Consulting Services can offer the specific guidance needed for those tricky edge cases.

It’s these kinds of complexities that lead many businesses to automation. Modern HR systems are designed to handle these calculations without breaking a sweat. You just configure the platform with your company’s full-time hours and pro rata policies. The system then automatically applies the right rules to work out salary, holiday entitlement, and pension contributions for any employee, which eliminates manual errors and saves the HR team a massive amount of time.

Ready to automate your payroll and guarantee compliance? DynamicsHub can help. Phone 01522 508096 today or send us a message to find out how we can configure a system that handles these UK payroll intricacies for you.